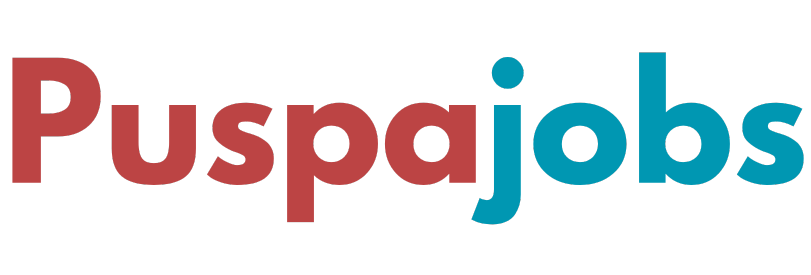

For entrepreneurs in India, managing taxes efficiently is a critical part of business planning. By leveraging tax-saving schemes, entrepreneurs can reduce their taxable income, improve cash flow, and reinvest savings into their business. Here’s a guide to the top tax-saving schemes available for entrepreneurs in 2025.

Section 80C – Investments and Expenses

Section 80C of the Income Tax Act is one of the most popular ways to save taxes. Entrepreneurs can claim deductions up to ₹1.5 lakh annually on investments such as:

- Life Insurance Premiums

- Employee Provident Fund (EPF) contributions

- Public Provident Fund (PPF)

- Equity-Linked Savings Schemes (ELSS)

Careful selection of 80C investments can help entrepreneurs build wealth while saving taxes.

Section 80D – Health Insurance Premiums

Entrepreneurs can claim deductions for health insurance premiums under Section 80D. This applies to premiums paid for themselves, their family, and dependent parents. The maximum deduction ranges from ₹25,000 to ₹1,00,000 depending on age and coverage. Health insurance not only saves taxes but also provides financial protection in emergencies.

Section 35AD – Capital Expenditure

Section 35AD allows entrepreneurs to claim deductions on capital expenditure incurred for specified businesses such as cold storage, warehousing, and infrastructure development. This deduction reduces taxable profits and encourages investment in business growth and expansion.

Startup Tax Exemption – Section 80IAC

Eligible startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) can avail a 3-year tax holiday under Section 80IAC. This applies to profits earned in the first 7 years of operation. Entrepreneurs must meet eligibility criteria such as innovation, turnover limits, and government recognition to benefit from this exemption.

Section 80G – Donations

Entrepreneurs who make donations to specified charitable institutions or funds can claim deductions under Section 80G. Donations not only contribute to social causes but also reduce taxable income, providing a dual benefit of philanthropy and tax saving.

Section 10(38) – Long-Term Capital Gains

Profits from the sale of long-term capital assets like equity shares or mutual funds may be exempt from tax under Section 10(38) if they meet specific holding period and transaction conditions. Entrepreneurs investing in long-term financial instruments can benefit from this exemption while growing their portfolio.

Depreciation Benefits

Claiming depreciation on business assets such as machinery, vehicles, computers, and office equipment reduces taxable profits. Accelerated depreciation rates are available for certain assets, helping startups and small businesses save significantly on taxes while reinvesting in their operations.

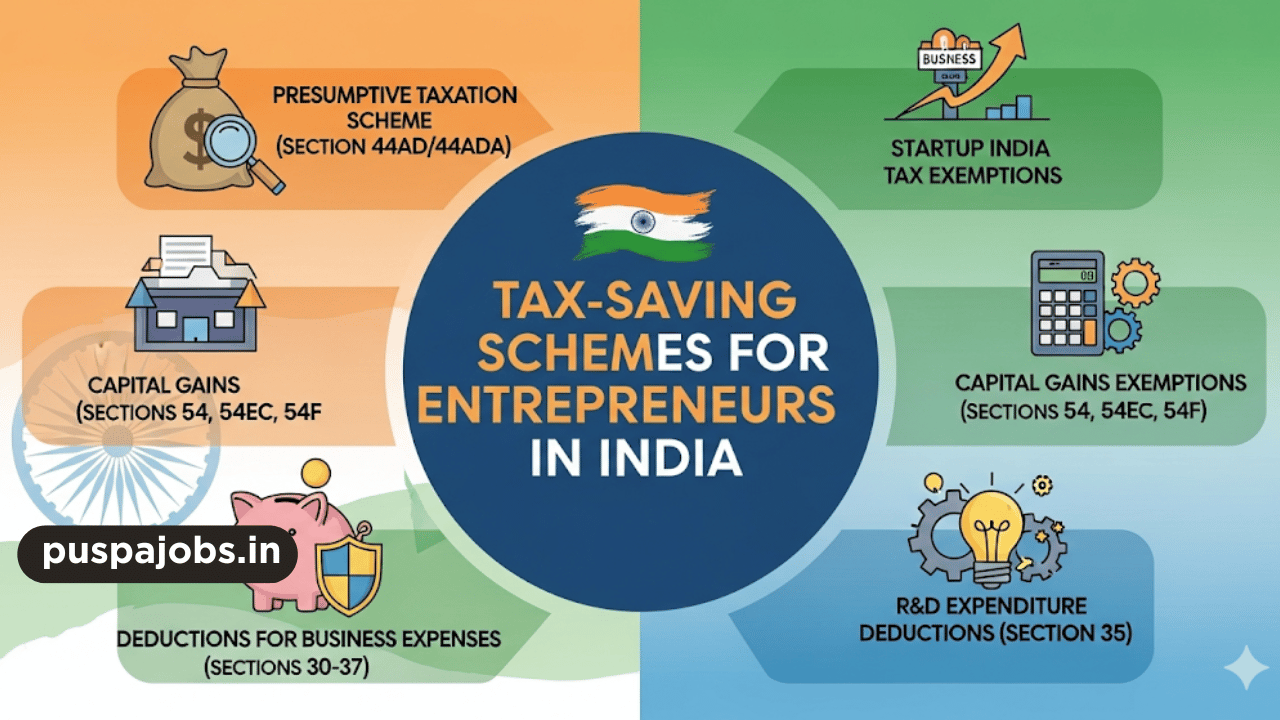

Professional Tax and Business Expenses

Certain business-related expenses, including professional tax, rent, salaries, and operational costs, are fully deductible when calculating taxable income. Entrepreneurs should maintain proper records and invoices to ensure all eligible expenses are claimed.

Conclusion

Tax-saving schemes play a vital role in improving the financial efficiency of entrepreneurs in India. By utilizing provisions under Sections 80C, 80D, 35AD, 80IAC, and others, entrepreneurs can reduce their tax liability, protect personal wealth, and reinvest savings into business growth. Strategic planning and awareness of available deductions and exemptions allow entrepreneurs to optimize finances and strengthen their business foundation in 2025 and beyond.