Starting a business in India requires adequate funding to turn ideas into reality. For new entrepreneurs, understanding various funding options is crucial to ensure smooth operations, growth, and sustainability. In 2025, India offers multiple avenues for startup funding, ranging from government schemes to private investors. This guide explores the best funding options available for new entrepreneurs in India.

Bootstrapping

Bootstrapping refers to starting a business using personal savings or revenue generated from the business itself. This approach allows entrepreneurs to maintain full control without external interference. Bootstrapping is ideal for small-scale startups or online businesses that require minimal investment. While it may limit rapid expansion, it ensures financial discipline and independence.

Friends and Family

Raising funds from friends and family is a common approach for new entrepreneurs. This method relies on personal trust and relationships, making it easier to secure early-stage capital. However, it is essential to maintain transparency, create formal agreements, and clearly communicate risks to avoid misunderstandings.

Bank Loans

Banks in India offer various loan schemes for startups, including Small Business Loans and Working Capital Loans. These loans typically require collateral and a solid business plan. Government-backed schemes such as the Pradhan Mantri Mudra Yojana (PMMY) provide low-interest loans specifically targeted at micro and small enterprises, making bank loans a viable funding option.

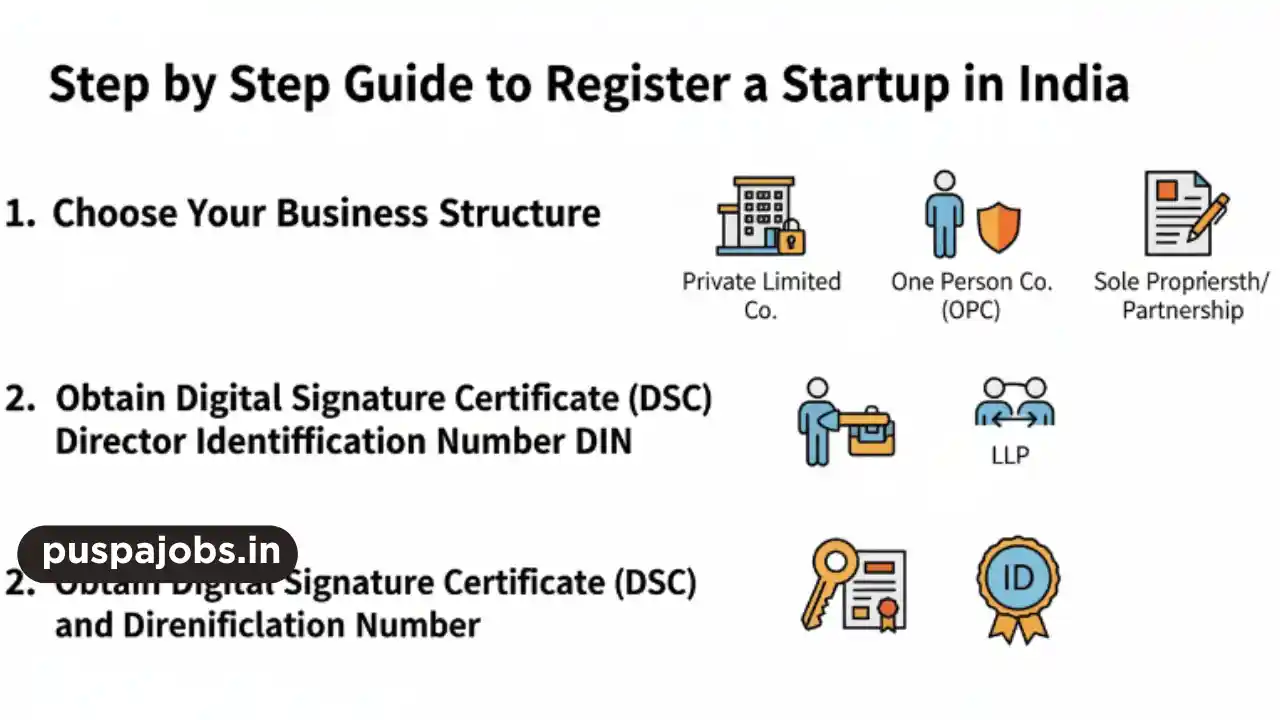

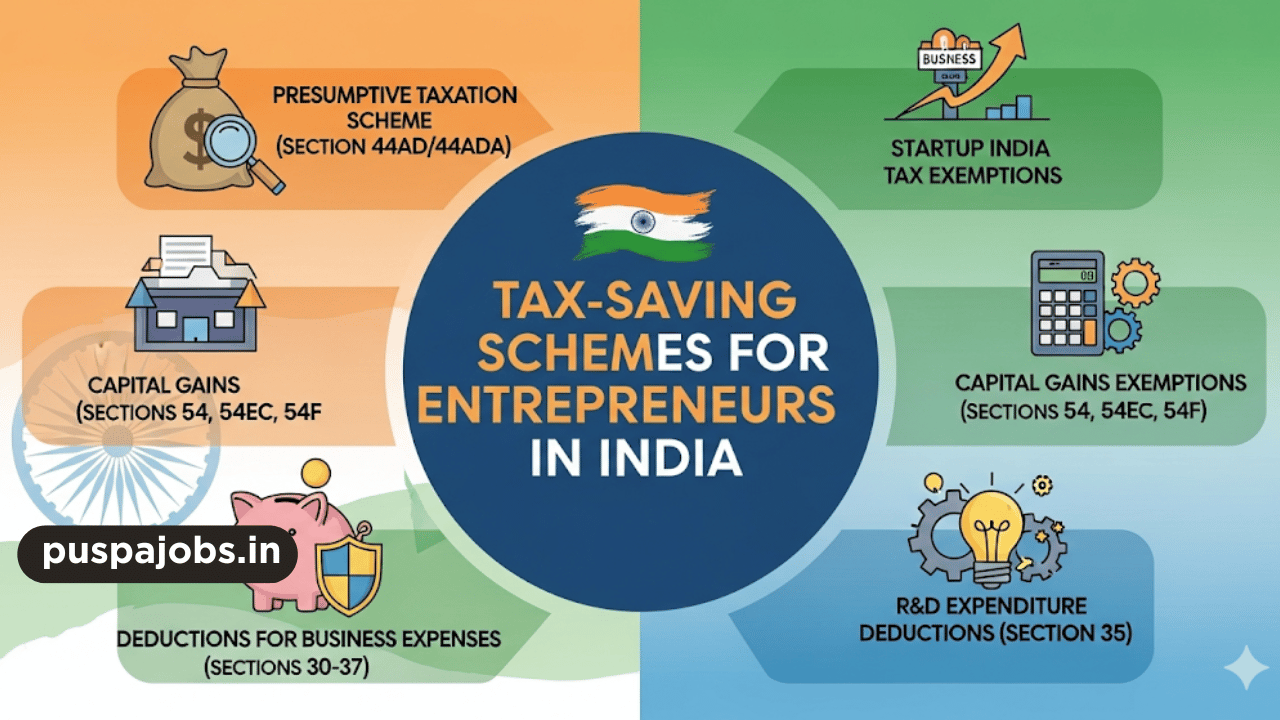

Government Grants and Schemes

The Indian government provides multiple grants and schemes to support startups. Programs like Startup India, Atal Innovation Mission, and sector-specific schemes offer financial assistance, incubation support, and tax benefits. Registering as a startup under these programs can open doors to funding, mentorship, and networking opportunities.

Angel Investors

Angel investors are individuals who invest their personal funds in early-stage startups in exchange for equity. They not only provide capital but often mentor and guide entrepreneurs. Platforms like Indian Angel Network (IAN) and Mumbai Angels connect startups with potential investors interested in high-growth opportunities.

Venture Capital (VC) Funding

Venture capital firms invest in startups with high growth potential in exchange for equity. VC funding is suitable for businesses that require substantial capital for scaling operations, technology development, or market expansion. Entrepreneurs should be prepared with a detailed business plan, projections, and a scalable model to attract VC investors.

Crowdfunding

Crowdfunding platforms allow entrepreneurs to raise small amounts of capital from a large number of people, usually online. Platforms like Ketto, Wishberry, and Crowdera enable startups to pitch ideas and secure funds from supporters interested in the project. Crowdfunding is ideal for innovative products, creative projects, or socially impactful ventures.

Incubators and Accelerators

Startup incubators and accelerators provide funding along with mentorship, workspace, and networking opportunities. Programs like T-Hub, Startup Village, and iCreate support early-stage entrepreneurs by providing seed funding, training, and exposure to investors, helping them refine business models and scale efficiently.

Microfinance and Cooperative Societies

Microfinance institutions and cooperative societies provide small loans to entrepreneurs in rural or semi-urban areas. These loans are particularly beneficial for women entrepreneurs or startups with low initial capital requirements. Microfinance programs focus on financial inclusion and community development.

Bootstrapping Through Revenue Growth

Once a startup starts generating revenue, reinvesting profits back into the business is a sustainable funding approach. This method reduces dependency on external investors and allows entrepreneurs to grow organically. It works best for businesses with steady demand and scalable operations.

Conclusion

New entrepreneurs in India have a wide range of funding options, from personal savings to venture capital and government schemes. Choosing the right funding source depends on the nature of the business, growth potential, and financial requirements. By understanding these options and strategically planning, entrepreneurs can secure the necessary capital to launch, sustain, and scale their startups successfully.