Financial planning is essential for students and young professionals in India to achieve long-term stability, build wealth, and avoid debt. Developing smart money habits early in life can help manage expenses, save for future goals, and make informed investment decisions. Here’s a comprehensive guide to practical financial planning tips for young individuals in 2025.

Set Clear Financial Goals

The first step in financial planning is defining short-term and long-term goals. Short-term goals may include saving for a laptop, a course, or travel, while long-term goals involve buying a home, starting a business, or retirement planning. Clear goals help prioritize spending, track progress, and allocate funds efficiently.

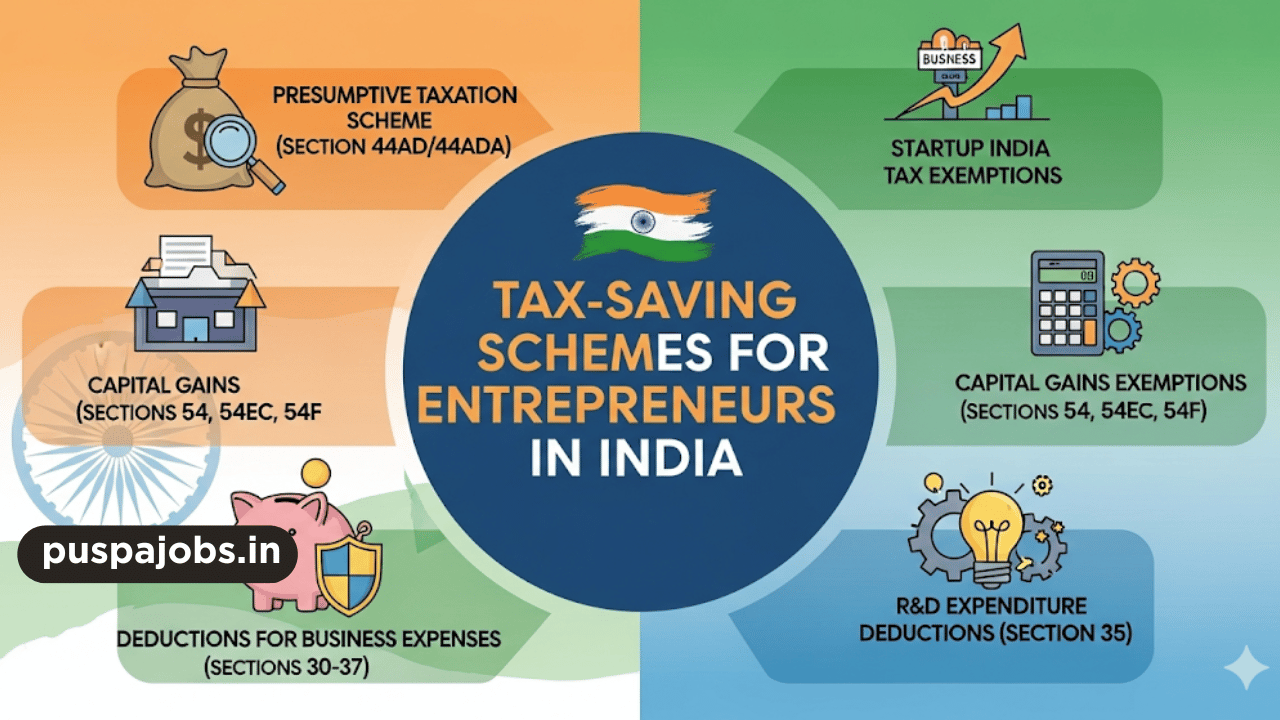

Create a Monthly Budget

Budgeting is a cornerstone of financial discipline. Track all income sources and categorize expenses into essentials, discretionary spending, and savings. Allocating a fixed portion of income to savings ensures consistent accumulation of funds. Using budgeting apps or simple spreadsheets can make monitoring easier and reduce unnecessary expenses.

Build an Emergency Fund

Unexpected expenses, such as medical emergencies or job changes, can disrupt finances. Maintaining an emergency fund with 3–6 months of living expenses provides a safety net. This fund should be easily accessible, such as in a savings account or liquid mutual funds, to avoid financial stress during emergencies.

Avoid Unnecessary Debt

Students and young professionals should avoid high-interest debt like credit card overspending or payday loans. If borrowing is necessary, choose low-interest options and ensure timely repayment. Responsible borrowing maintains a good credit score, which is essential for future loans or financial opportunities.

Save and Invest Early

Starting to save and invest early maximizes the benefits of compounding. Begin with small investments in options like Public Provident Fund (PPF), recurring deposits, mutual funds, and National Pension Scheme (NPS). Gradually diversify into stocks, ETFs, or real estate based on risk appetite and financial knowledge. Early investment secures long-term financial growth and retirement planning.

Manage Daily Expenses Wisely

Smart spending habits can help maximize savings. Avoid impulsive purchases, compare prices, use student discounts, and adopt cost-effective alternatives for daily needs. Meal planning, public transport, and avoiding brand-heavy expenses can make a significant difference in monthly savings.

Monitor and Review Finances Regularly

Regularly reviewing financial status helps in adjusting budgets, reallocating investments, and tracking progress towards goals. Keep records of income, expenses, and investments, and evaluate financial plans quarterly or biannually. Continuous monitoring ensures disciplined financial behavior and timely corrective actions.

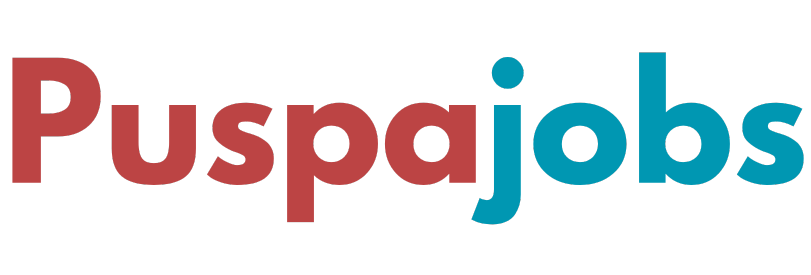

Seek Financial Education and Advice

Understanding basic financial concepts is crucial for informed decisions. Attend workshops, read articles, and consult financial advisors for guidance on saving, investing, and tax planning. Knowledge empowers students and young professionals to make smart choices and avoid financial pitfalls.

Conclusion

Effective financial planning for students and young professionals in India lays the foundation for long-term wealth creation and financial stability. By setting goals, budgeting, saving, investing early, managing debt, and seeking financial education, young individuals can achieve financial independence and security. Developing disciplined money habits today ensures a stress-free and prosperous financial future in 2025 and beyond.