Saving money consistently is essential for financial stability, especially for middle-class families in India. With rising living expenses, it is important to adopt practical strategies to manage income, reduce unnecessary expenditure, and build a financial cushion for future needs. Here’s a comprehensive guide to the best ways middle-class families can save money every month.

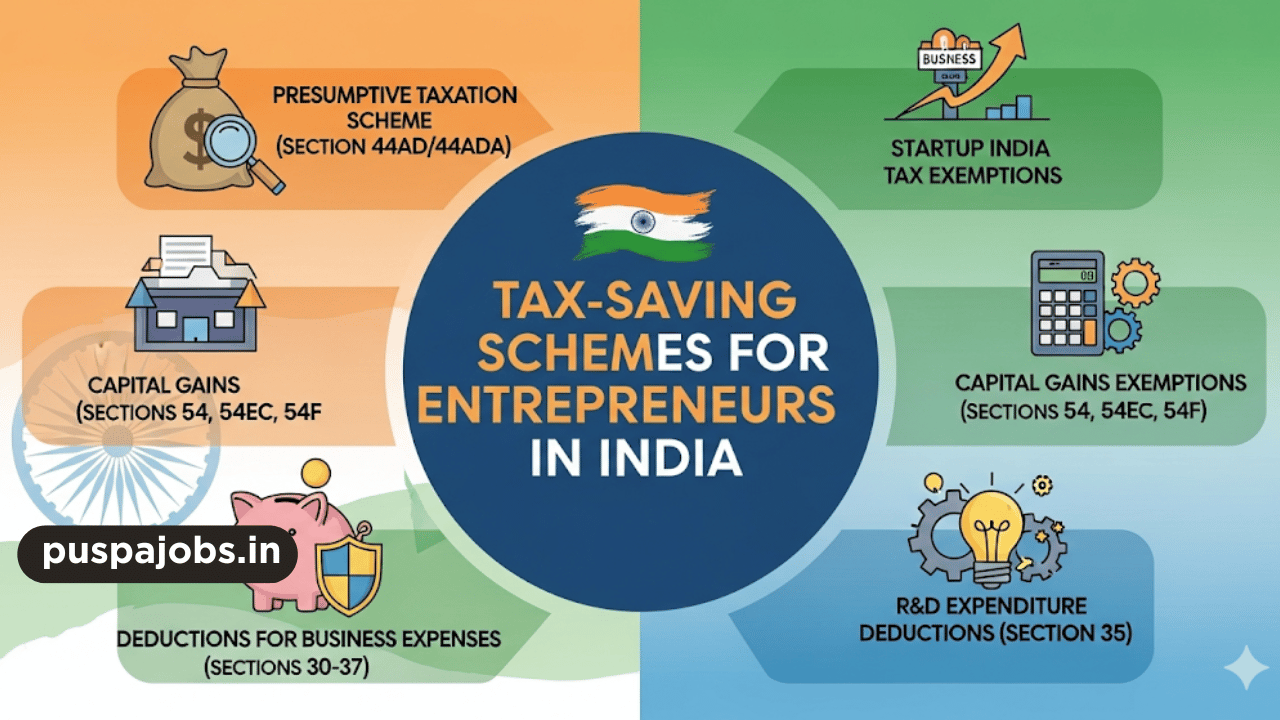

Create a Monthly Budget

The first step to saving money is creating a detailed monthly budget. Track all sources of income and categorize expenses into essentials, discretionary spending, and savings. Allocating a fixed portion of income to savings ensures that money is reserved before spending on non-essential items. Using budgeting apps or spreadsheets can make tracking easier and more accurate.

Reduce Unnecessary Expenses

Identify and cut down on unnecessary expenses that do not contribute to long-term well-being. This can include dining out frequently, impulsive shopping, subscription services not in use, or excessive utility usage. Making conscious choices and distinguishing between wants and needs helps free up money for savings and investments.

Opt for Cost-Effective Grocery and Utility Management

Grocery and utility bills form a significant part of monthly expenses. Buying groceries in bulk, choosing local markets, and using discount offers can reduce costs. Similarly, conserving electricity, water, and fuel can lead to substantial savings over time. Simple changes like using energy-efficient appliances and switching to LED lighting can make a difference.

Automate Savings

Automating savings ensures consistent accumulation of funds. Setting up auto-debit to a savings account or recurring deposit immediately after receiving salary prevents unnecessary spending and promotes disciplined financial habits. Even small amounts saved every month can grow significantly over time through interest and compounding.

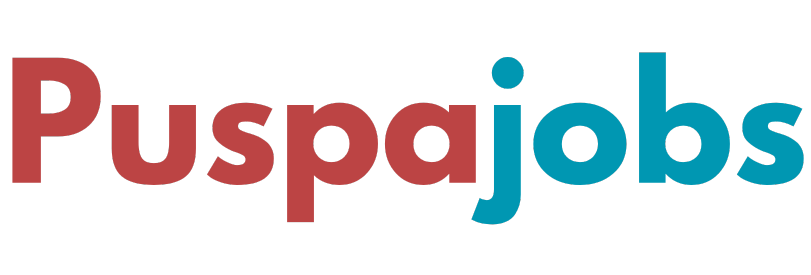

Invest Wisely

Saving money is more effective when coupled with smart investments. Middle-class families can explore options like fixed deposits, Public Provident Fund (PPF), mutual funds, National Savings Certificates (NSC), and recurring deposits. Investing in these instruments not only safeguards money but also helps it grow with time, providing financial security for emergencies and future goals.

Avoid High-Interest Loans and Credit Misuse

Excessive borrowing and misuse of credit cards can erode savings. Avoid taking high-interest loans or spending beyond means. If loans are necessary, opt for lower interest options and create a repayment plan to minimize financial stress. Responsible credit usage ensures that money intended for savings is not consumed by interest payments.

Plan for Emergencies

An emergency fund acts as a safety net for unforeseen expenses such as medical emergencies, home repairs, or sudden financial requirements. Setting aside 3–6 months’ worth of living expenses in a separate account ensures financial stability and prevents disruption to regular savings.

Encourage Family Participation

Involving all family members in financial planning promotes collective discipline and awareness. Teaching children about the importance of money management, prioritizing needs, and encouraging responsible spending strengthens the family’s overall financial health.

Conclusion

Middle-class families in India can achieve financial security by adopting structured saving habits, reducing unnecessary expenses, and making informed investment decisions. Creating a monthly budget, automating savings, managing utilities wisely, and planning for emergencies are practical strategies to save money consistently. With discipline and thoughtful financial planning, families can build a strong financial foundation, achieve their goals, and enjoy peace of mind in the long run.