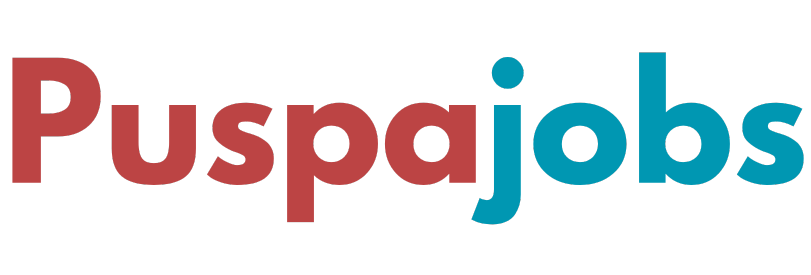

Managing business expenses is crucial for startups in India to ensure sustainability, profitability, and gth. Poor expense management can quickly lead to cash flow problems, affecting operations and future expansion. By adopting structured strategies, startups can control costs, optimize resources, and focus on scaling their business efficiently.

Understand Your Expenses

The first step in managing expenses is understanding where money is being spent. Categorize expenses into fixed costs (rent, salaries, utilities) and variable costs (marketing, raw materials, logistics). Maintaining a detailed record of all expenses helps identify areas where costs can be optimized, avoid unnecessary spending, and plan budgets effectively.

Create a Monthly Budget

Developing a monthly budget is essential for financial discipline. Allocate funds for different business functions such as operations, marketing, salaries, and contingencies. Set spending limits and track actual expenses against the budget. This practice ensures that funds are used efficiently and prevents overspending.

Separate Business and Personal Finances

Many startup founders make the mistake of mixing personal and business finances. Maintaining separate accounts for business operations helps in accurate tracking of expenses, simplifies tax filing, and enhances financial transparency. It also makes it easier to analyze profit margins and business performance.

Optimize Operational Costs

Operational costs often form a major part of startup expenses. Identify opportunities to reduce costs without affecting productivity. Examples include negotiating supplier contracts, using cost-effective tools and software, automating repetitive tasks, and outsourcing non-core functions. Optimizing operations can significantly reduce overheads.

Monitor Cash Flow Regularly

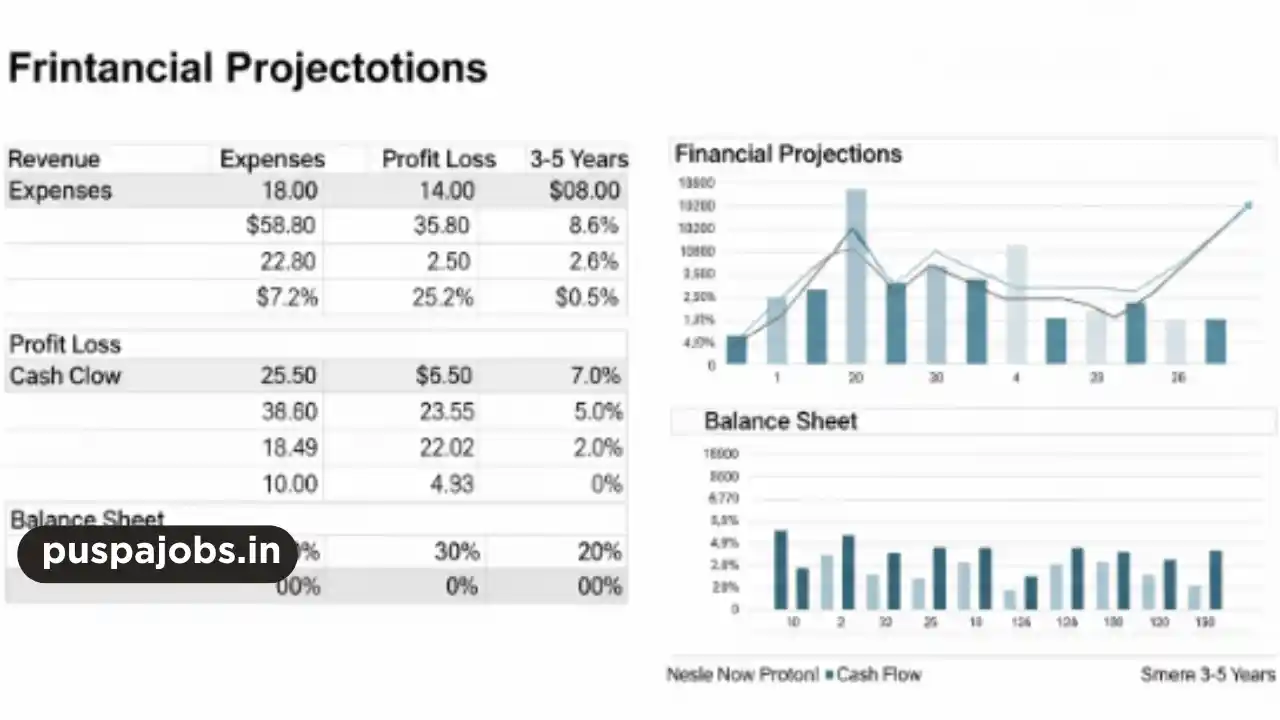

Monitoring cash flow ensures that the business has sufficient funds for day-to-day operations and upcoming obligations. Use accounting software or spreadsheets to track income and expenses. Regular cash flow analysis helps in forecasting financial needs, avoiding shortages, and planning for future growth.

Implement Cost-Saving Measures

Startups can adopt various cost-saving measures such as:

- Using co-working spaces instead of renting large offices

- Hiring interns or freelancers for specific tasks

- Leveraging digital marketing over traditional advertising

- Minimizing utility and resource wastage

These steps help startups operate leanly while maintaining efficiency.

Track and Review Expenses

Regularly reviewing expenses allows startups to identify patterns, detect unnecessary spending, and make informed decisions. Monthly or quarterly reviews provide insights into financial performance and help in adjusting budgets, renegotiating contracts, or reallocating resources.

Use Technology for Expense Management

Accounting and expense management software simplify tracking and reporting. Tools like Tally, Zoho Books, QuickBooks, and Expense Manager allow startups to automate invoices, track payments, and generate financial reports. Technology reduces manual errors and saves time, enabling founders to focus on core business activities.

Conclusion

Effective expense management is vital for the success of startups in India. By understanding expenses, creating budgets, separating personal and business finances, optimizing operations, monitoring cash flow, and using technology, startups can maintain financial control and achieve sustainable growth. Careful planning and disciplined expense management ensure startups can maximize profits, reduce financial stress, and scale successfully in 2025 and beyond.